Our source for the majority of the property trends we are seeing in Randburg, Johannesburg comes from the FNB Property Barometer. Firstly, let’s consider the major trends:

- Globally, inflation is decelerating. This may mean the start of the end to hiking interest rates.

- Locally in SA – we may have come to the top of the graph in terms of our interest rate hikes. We may get one more interest rate hike before the end of 2023 but economists are optimising that more measured interest rate cuts will start to ease from June 2024. Given our domestic inflationary pressure, the SARB may implement rate cuts a little sooner.

- Our income in the last quarter is subdued with many of the big brands considering further strategies to stimulate growth and to get volumes and gross turnover up.

- Unemployment rates continue to rise, especially across younger age groups which is creating a lower-than-usual appetite for first-time buyers.

There Is Some Good News Though

According to IOL there is some good news and this time coming from the lending or home loan sector:

- Although there has been a 25% decline in home loan applications during a tough property market, financial institutions have a bigger appetite to keep growing their market share.

- More than 80% of home loan applications are now being approved.

- There has been a general increase in the average size of deposits to support home loan applications.

- The banks are offering very competitive rates to buyers at the moment, with an average rate below the prime lending rate.

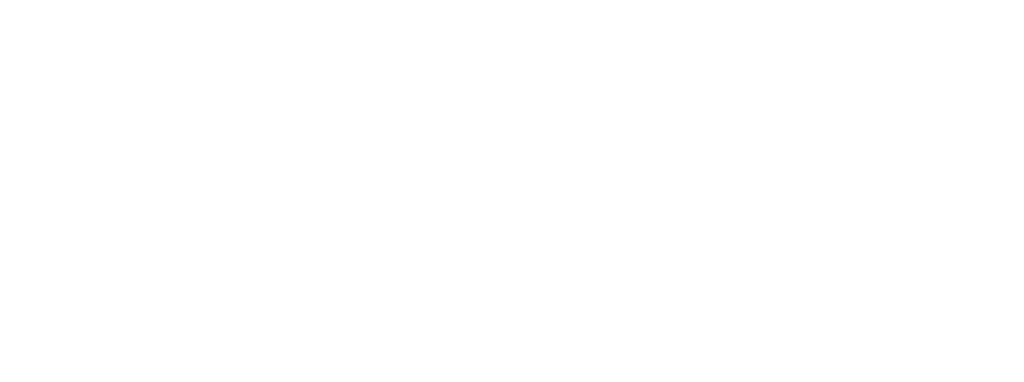

House Price Index Is Key When Considering The Current Property Trends

This graph is what is hurting us at the moment. The yellow line at the top is dropping. This means that house price growth is much lower, again for the end of August compared to the latter part of 2021 when prices climbed. If you have plans to sell your property it is absolutely essential that you get a realistic and market-related property valuation. Simply, price it right and it will sell. Price it wrong and it will take long.

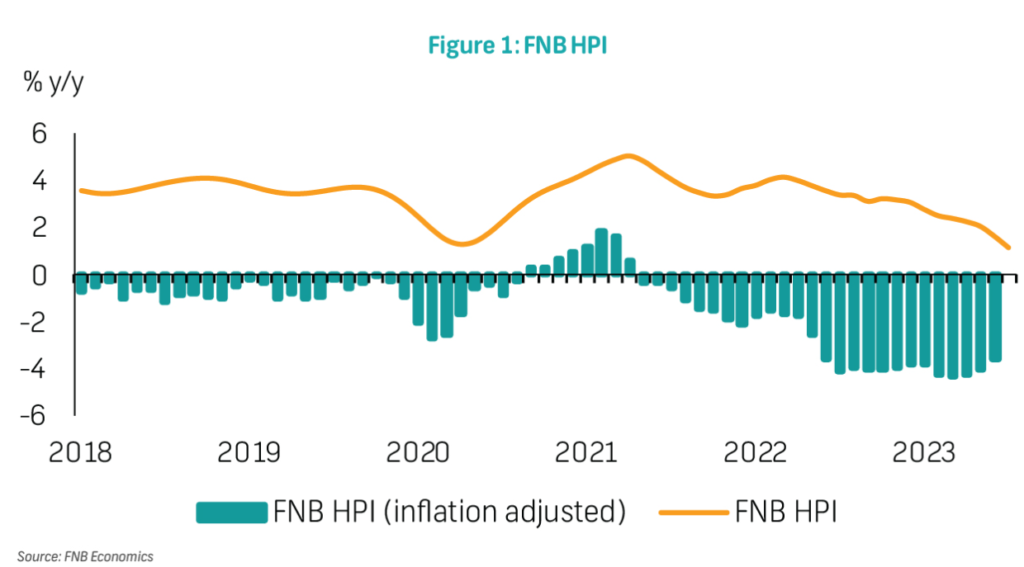

Property Trends Point To Lower Property Registrations Across SA

Again, this speaks to the current market. Fewer buyers means fewer sales which leads to fewer registrations. In fact, the volumes are so low at the Deeds Office that a property sale can and will go from Lodge to Registration in under 5 days. Normally in times of peak volumes, this can take as long as 14 – 20 days.

Property Sales Prices Have Slowed Again Impacting Property Trends

FNB notes the House Price Index (HPI) as 1.1% which is down from 1.6% in June of this year. Falling prices in a buyer’s market means if your property is not priced correctly you will simply not get noticed and a sale at the price you had in mind will probably not materialise. This is a significant note because we are seeing, again a decline in HPI levels over a 14-year period.

Confirmed Property Trends That Are Evident

- Demand for property is lower.

- There are fewer properties being sold.

- House price growth is down to levels seen 14 years ago.

- Higher finance servicing costs which is chewing up a family’s disposable income.

- More budget-friendly alternatives are being considered.

- First-time home buyer’s levels and volumes are more affected by unemployment.

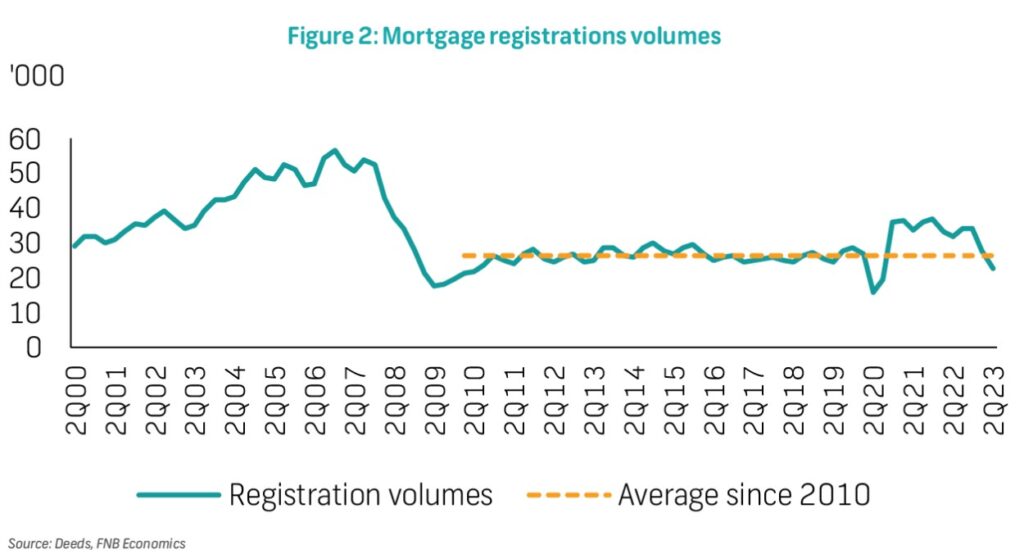

Average Home Loan Size As A Property Trend

81% of sellers in the July 2023 survey have had to drop their prices to get noticed online by buyers. This is against a 75% in June 2023. Prices are falling and it is time to recalibrate what you will earn when you sell your property. Also, keep a keen eye on the net once you sell.

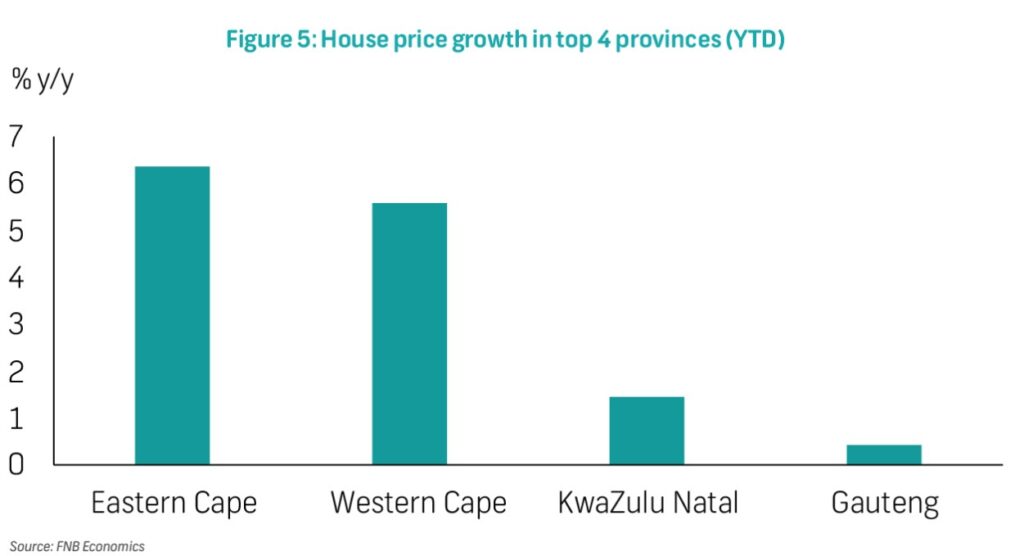

HPI By Province to See What The Trends Look Like, Nationally

Gauteng is the hardest hit. The Eastern Cape and Western Cape are doing well, but we all know the demand for property, for sale or to rent in these provinces is high.

Get in touch with KW Select – We Will Help You Navigate Any Property Trend

If it’s time to sell, and you need an estate agent to provide you with an accurate property valuation for the current market, click here. If you are on the lookout for your dream home, then click here to view all the properties on the market for sale or to rent from Keller Williams South Africa. Need help with getting a pre-approved home loan with the best rate over the term of your loan (20 years), then click here. Call 064 549 3123 to speak to one of our KW Select sales consultants. Or, visit our website to book your property valuation or view all the Keller Williams properties for sale across SA, online.